Track your income and expenses, painlessly

The best features of ZipBooks Free are. User friendly and intuitive. No payment card needed. Cleanup is a pay per use feature that you can use to reconcile historical accounts and categorize historical transactions. This allows landlords to better monitor performance of their portfolio and make better, informed decisions about their properties. Forecast automatically imports your team’s time registrations into your invoices for easy sharing. Using accounting software is an easy way to do your small business accounting, financial management, and reporting on your own. The most successful construction companies out there understand the importance of construction specific software and adopt this early on. The service stands out because it’s easily customizable, comes in multiple versions with hundreds of add on apps, and offers better mobile access than most rivals. Finance teams typically see a productivity boost of 40 percent or more. That said, if you insist on being able to pay bills through the accounting software, FreshBooks and QuickBooks Online are tied for first here. Take a moment to look at the features, functions, support, and integration into your firm. Founded in 2003, FreshBooks has grown into its status as trusted accounting software not only in Singapore but across the globe. You can also monitor any and all loans in a single location. Pixie’s streamlined approach to workflow management will save time while maintaining consistently high standards. Its low starting price and excellent app also make it a prime fit for freelancers, contractors, and other sole proprietors. With NetSuite Planning and Budgeting Smart View you can create customizable financial reports that allow you to drill down into specific transactions and track each of the numbers cited in reports. Others, such as Intuit QuickBooks Online and Xero, read the receipts and transfer some of their data such as date, vendor, and amount to an expense form using optical character recognition technology. While you’re thinking about your money, you might also like to consider our reviews of online payroll services and personal finance managers. Do I need my credit card details to sign up for your accounting software. Tracking expenses is easy. Data Safety and Security. If you’re traveling and have numerous related expenses on the road, for example, then you can often take pictures of receipts with your smartphone.

Why going for paperless accounting makes sense

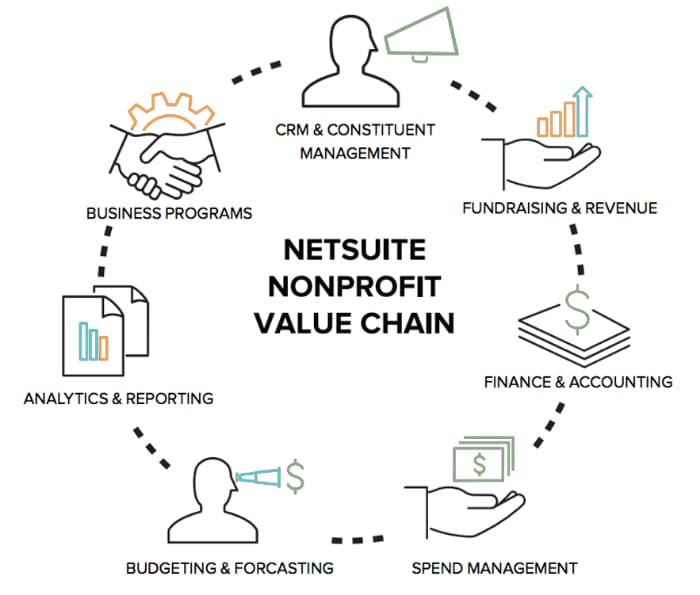

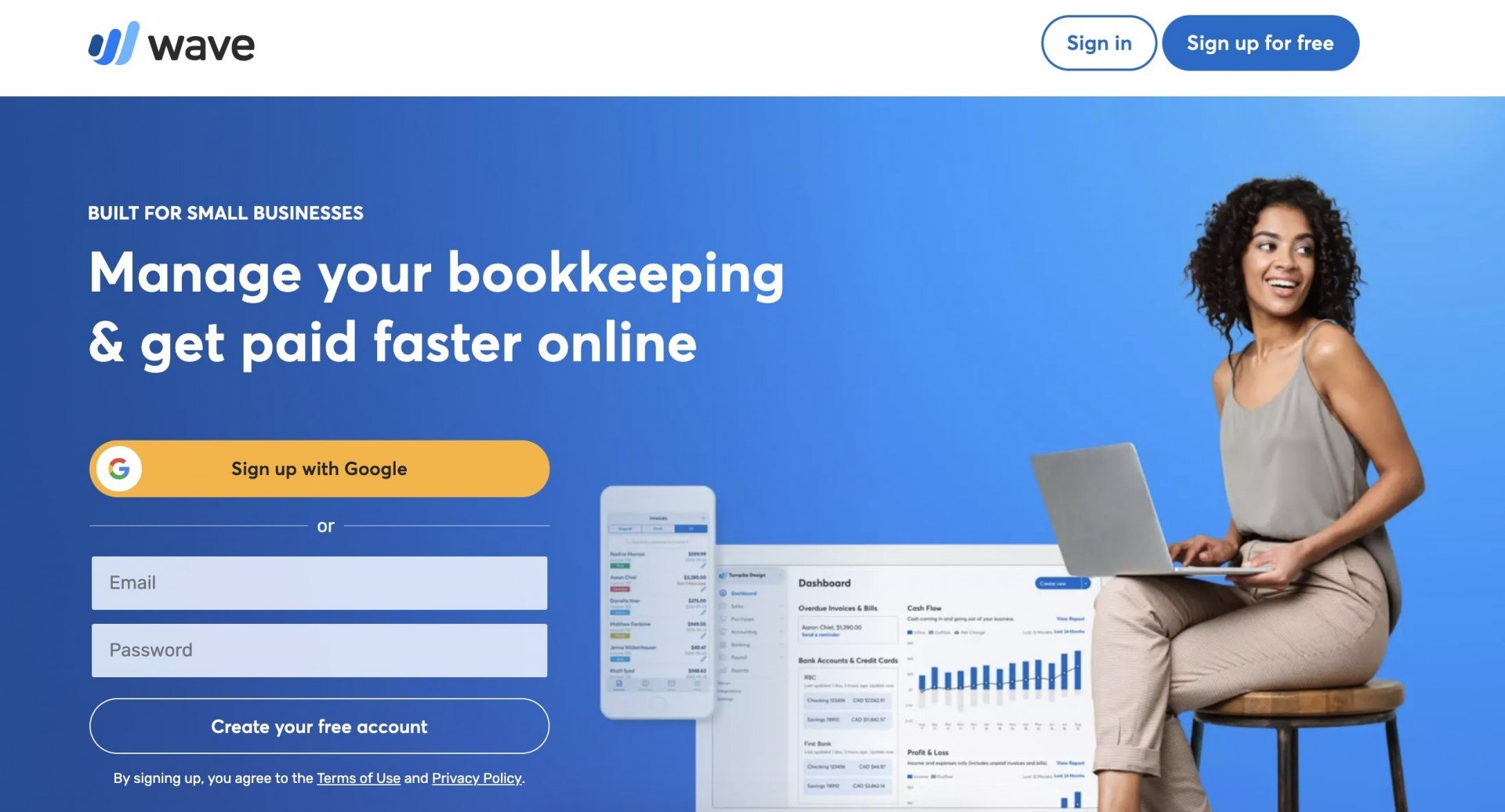

Running a nonprofit can take a lot of time as it is. The software uses a question based process to emphasize the features you need and then everything is easily accessible from a modern web based dashboard. Tax season doesn’t have to suck. Online accounting software and bookkeeping software is secure. If you’re looking for a QuickBooks esque solution at a lower price point, we recommend Zoho Invoice for a free option or Xero for an affordable paid option. If all this sounds too good to be true, sign up for a free account and see how Wave can help you manage your business’s accounts in less time––all without spending a dime. QuickBooks Online and FreshBooks have integrated payment processing. Incidentally, you can pay month to month, but the cost goes up. Otherwise, Zoho Books starts at $15 a month if you pay annually or $20 if you pay month to month. Accounting software knows that people want everything in one place, which is why most have interactive homepages where people can quickly sign in and get things done. Create professional invoices. 4% plus 30 cents per transaction, and bank transfers cost 1%.

Cloud accounting for your entire property portfolio

Xero’s pricing and plans are based on size, making it the best accounting software for growing businesses. Facebook Twitter LinkedIn YouTube. Our mission is to break apart what is automated accounting system what CRM is and means. Org, our research is meant to offer general product and service recommendations. By giving everyone in your organization access to the same up to date information, they help you break down internal boundaries between teams and automate core processes. Detailed Gusto Review. It may be advisable to familiarise yourself with this before deciding to compile accounts using a spreadsheet. On top of that, it allows you to tackle all of your accounting tasks without the need to install programs on your computers. All Zoho Creator apps are automatically available natively on mobile, so you can access your accounts and view statements from wherever you are, whenever you need to. When you need to reference a customer in a transaction, they will appear in a list. Com, Re Leased, Really Simple Systems CRM, Rydoo, Sage 50cloud Accounting, Sage Business Cloud Accounting, SalesSeek, Sapaad, Satago, ServiceM8, Shoeboxed, Shopify, Simple Salon, Solve CRM, Spotlight Reporting, Square Point of Sale, Starshipit, Streamtime, Stripe, SugarCRM, Synchroteam, Synergy, Tabology EPOS, Tidy, Time Tracker, TimeCamp, Timely, Tradify, Trigger, Unleashed, Veeqo, Vend, WORKetc, WooCommerce, Workato, WorkflowMax, XEDI Web EDI, XO Cashflow, ZENOTI, Zahara, Zapier, Zendesk Sell, Zoho Analytics, Zoho Books, Zoho CRM, ezyCollect, ezyVet, simPRO, vWorkApp, webexpenses. In many cases, they’re offered in the context of a “freemium” model — they essentially provide the bare essentials as a preview for a fully fleshed out application. 50 per month for each additional user. Additionally, being able to log into multiple devices at once means you’ll always have access to your accounting data from wherever you are, and when it’s most convenient. Primo Payroll from Accentra is a highly rated provider of payroll services and software, some of which has been created specifically with accountants in mind. It includes a full suite of six transformative digital features for securing signatures, automating compliance, intelligent form fill, document management, fraud detection, and authentication and validation. Brightbook is a web based accounting solution tailored to suit the needs of independent contractors, freelancers, and small business owners — though it tends to work better for the former two. LeaseQuery’s proven solution and CPA approved calculations facilitate simple, confident compliance. Their Nonprofit General Ledger structure enables reporting by project, grant, department, or any characteristic that suits your organization, and you can also create multiple “what if” budget scenarios to measure the impact of potential change. On FreshBooks’ secure website. With the Aspire Business Account automatically linked to Xero, it makes accounting for your business a walk in the park. These features help keep our invoicing, and accounting, free. Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Sooner or later, you’ll find the one for you, and the wait will be totally worth it. Hook up every one of your UK bank and credit card accounts and you’ll be able to see each of your balances in a single place with a single login. Any of the above packages may prove a useful tool for your business, and reduce the amount of work you need to give to an external accountant. With more and more businesses adopting a hybrid work arrangement, the need for cloud based services is still on the rise. There is, however, quite a bit of variance in app capabilities. Additionally, we do not recommend GoDaddy Online Bookkeeping.

8 Profitable Ecommerce Niches to Consider in 2022 Backed by Research

If you’re interested in a solution that can help you keep your accounts payable process straightforward and timely, check out Tipalti. Pricing is not publicly available. The platform is built with user friendly features and an easy to navigate interface that allows businesses to send mass payouts to their employees, whether they are working remotely or on site. But while there used to be Mac software and PC software, it’s now virtually all the same with the ever increasing expansion of cloud based software that works seamlessly in any browser. This software does much more than send invoices though you shouldn’t overlook its stellar invoicing features—Zoho Invoice is actually our top pick for billing and invoicing software. Business management software for contractors and architects. Cut monthly close time by up to 50% If your monthly close takes 20 30 days to complete, that means the consolidated data and reporting you’re providing to decision makers is a month old. As an add on service, Wave provides two payroll options. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Hubdoc is the Xero tool that captures bills and receipts. Many free or cheap apps can perform this function just as well. The first is to earn enough money to keep your business going. Sunrise is a bookkeeping software specially made for small businesses. Detailed PayEm Review. If filing your taxes makes you nervous, and you want to be led through every step, Turbotax is a great tool to have ready. 20 Best Budgeting Software for Mac in 2023. Firms, freelancers and consultants who work with clients on projects or jobs should look for accounting software that helps them track their projects’ tasks and budgets. With QuickBooks’ Live Bookkeeper, you get access to a bookkeeper who sets up the software for you, categorizes transactions, reconciles accounts, closes books monthly and runs detailed reports. It’s ideally suited for those who want to save for retirement, as there’s a dedicated service called Acorns Later that will match you up with a suitable IRA account. You just need a bank account under the RBS, NatWest, Ulster Bank umbrella. Intuit has an option called QuickBooks Live that adds bookkeeping support to Intuit QuickBooks Online Plus. Xero is a powerful online accounting software solution. Its features include vendor data management, investor grade reporting, benchmarking, customizable dashboards, and progress tracking.

6 CloudBooks

Thankfully apps are constantly making it easier to track and organize important data. Wave cannot track unpaid bills accounts payable. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low. Signing up only takes a few minutes. Simplify your work by collaborating with employees, contractors, accountants, or other team members. One of the great things about using small business accounting software is that it reduces repetitive data entry. Hubble includes a flexible library with 240 out of the box pre built financial report templates. It regularly pulls your score daily from two of the three major bureaus, and gives you access to your credit reports. Even users with no prior accounting experience can balance the books, send invoices, and perform other accounting functions in no time using ZipBooks. However, the software has limited features and integrations. All B2B Directory Rights Reserved. Offers and availability may vary by location and are subject to change. For landlords who want complete freedom from the daily operations of their rentals, Hemlane can help you connect with local, in person leasing agents and 24/7 repair coordination with local service professionals. Maybe when starting out, you just need to be able to print off some invoices and driver settlements.

What is accounting and inventory management?

Personal Capital has free planning tools on its website, but it also has a team of financial professionals that provide advanced planning services for a fee. You just have to decide whether you want to spend the time upfront building your records or take time out when you’re in the middle of sales or purchase forms. Online software can help you stay organised and file your tax returns earlier and more accurately than ever, but if you don’t update it frequently, you’re setting yourself up for a fall. 7 January 2023: The blog has been updated on 7 January 2023 with relevant fresh content. Up to 90 bank payment formats. References to products, offers, and rates from third party sites often change. The conversion features allow you to convert accounting files from other formats to PDF. Set up several trial accounts or sign up for a free version and add sample data – such as customers, income and expenses, assets – to test how easy to use. The software will immediately get to work understanding your business: who your most frequent transactions are with, what you spend your money on, and what tax categories your expenses fall under. You may or may not see them at this point.

Bill Manager

Enhanced Payroll does not limit the number of payrolls scheduled per month. Get access to workers compensation administration, mobile employee time tracking for workers in the field and same day direct deposit. This also includes ensuring that the software you choose are HMRC recognised to comply with the new MTD laws – as all the ones on this list are – and integrate seamlessly with other softwares your small business might need to increase ease and convenience for you in your day to day life. Pre qualified offers are not binding. Facebook Twitter LinkedIn YouTube. For the top plans, you’ll get similar functionality from both providers. But those days are behind us. Contact Sage for your quote and demo to learn more. Buildium has a lease tracking feature that tracks leases, deposits, and monthly payments. Shopify app or integration: Yes. Then, you might need everything in a single app to manage all those estates. Collection and online payment can be made through methods preferred by your clients, eliminating the chance of you chasing that elusive check from your clients. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low. ERP accounting systems keep track of your financials whilst also maximising productivity.

Vi Reporting

Here is a list of the best benefits of business accounting software for any organization 1 Automates Tasks This way, it’s easier for busy entrepreneurs to manage their time by delegating certain tasks to the computer, freeing them up from manual duties like data entry 2 Helps You Manage Your Time More Effectively As stated above, this helps entrepreneurs delegate tasks more efficiently 3 Helps Save Time While data entry can. A power failure or computer breakdown could cause a data loss or disruption. Your preference might depend on your business model and type. “Using an accounting package will help organize your records and ‘force’ you into a systematic structure,” Ken Stalcup, senior director with Houlihan Valuation Advisors, told business. It improves stability and ensures results. Moreover, Wave has bookkeeping support for businesses wanting to outsource their bookkeeping to a Wave Advisor. All plans have a 60 day free trial, so you can try it for yourself with no obligation. NetSuite and Wave are our top recommended solutions for small businesses. Comprehensive mobile app. However, the most important thing is staying consistent and sticking to one accounting method when recording your transactions. You can also use to snap and capture receipts related to your expenses. You should track sales and expenses, manage finances, and invest in bookkeeping right from the onset of your eCommerce business. FloQast was founded by CPAs now inactive who understand the delicate balance between reliability and innovation. Workflow management for accountants must take care of onboarding accountants on the use of the new accounting platform so that they gain familiarity with its usage. It does everything that a small business owner like myself would need. Property Matrix also has a mobile app so that you can manage your properties on the go. We recommend working with an accountant or bookkeeper, preferably one with Xero experience, when you make the move to Xero cloud accounting software. SAVE UP TO 553 HOURS EACH YEAR BY USING FRESHBOOKS. Integration options: Not surprisingly, Zoho Books integrates easily with other Zoho products including Zoho CRM and Zoho Expense. With Unit4 ERP, this Canadian hotel chain eliminated 25,000 hours of manual data entry equivalent to approximately $750,000 savings annually. Firefly III supports all kinds. Sales tax may be applied where applicable. We found QuickBooks Online to be the best overall accounting software for small businesses. This tool is for everyone, small as well as growing businesses. And I love the interface. Rigbooks even adds up your IFTA mileage entries and fuel receipts. In that case, you may want to consider our review of Intuit QuickBooks, which has plans currently ranging from $15 to $42 per month. You’ll also be able to send and track invoices sent out, which makes tracking payments way easier. The accounting system you pick should be easy to use, but it should also be able to offer you assistance if you ever need it.

» How to choose the best Accounting Software?

Accounting method: Accrual and cash basis accounting. Should we invest in new equipment. I still ghostwrite monthly how to columns for accounting professionals. The Standard package is £24 per month and is ideal for small businesses that are looking to grow. Fortunately, there’s a better solution. Before jumping in, let’s look at what purpose accounting practice management software serves and some categories that I’ll be using to base this accounting solution roundup on. This is one of the many benefits of adopting Dynamics technology. Sage Accounting is available in two pricing packages. 60 per credit card transaction. The platform is also highly scalable and customizable. The platform integrates with many business applications and provides you with a single dashboard to manage your finances and accounting. Naturally, the company provides email and phone support to subscribers, with representatives available during regular business hours. That structure can work for businesses growing at any rate. For more information on the managing user rights or deleting clients, please see here. Getting all this for free as an RBS/Natwest business banking customer is very tempting, but make sure you consider the potential consequences of giving up access to your detailed financial data in return. Each additional user costs $10 per month. That said, here is the list of the best 20 accounting software for nonprofits you can implement in your institution. Trusted by over 160,000 small businesses. Accounting Automation shouldn’t be difficult. Layman Language Instructions. Further reading =>> Top alternatives to BlackLine. You can try the tool for free. In Quebec, the software requires Microsoft Windows or Parallel Desktop. The free version is exceptional. The app stays in sync between your desktop and the app so that you don’t miss a single update. Pento helps manage the payroll function no matter how advanced the finance operations may be. Registered trade names are used by, and refer to, a single FDIC insured bank, Green Dot Bank. 99/yr, manage your money and save with the Deluxe option at $46. Helps organize business expenses.

For the first 6 months, thenjust $33/m with code MOBB506M

Call Us Toll Free: 888 274 6053. The software allows you to send custom invoices, track inventory, and create purchase orders to attach to bills — all from your phone or tablet. “We were looking for an agile cloud solution that would deliver a new People Experience and intelligent insights to our teams. Our final software platform is Zoho Books, which is a powerful small business accounting platform with a world class mobile app. A great aspect of project accounting is that it is carried out while the project is ongoing. Get started using best in class accounting software for small business with a free 30 day trial. You are free to send an unlimited number of invoices to each customer, but the system will only allow you to keep data for a maximum of five customers at a time unless you upgrade to a more expensive plan. It will let you track your investments. In general, it reflects the global decline in FDI as the UNCTAD noted. Accounting software helps you stay on top of your financial data. This feature helps you remind customers about upcoming and past due payments. With ZipBooks, you get complete access to a suite of invoicing, accounting and expense management tools so your organization gets paid faster—and like we said, it’s free. Certify opens in new tabCertify is a solution for tracking expenses rather than full accounts, but could be very useful to have in addition to some of the platforms above, not least because not all of them can track expenses with such dedication. SAVE UP TO $7000 IN BILLABLE HOURS EVERY YEAR. Rising inflation in 2022 added to your financial woes. Accounting software offer features for tracking the revenue and expenses of a business. 5/5, and is only brought down by its mediocre support options neither live chat nor phone is offered, and live support is not 24/7, but it’s a great choice for general use and functionality. Accounting needs to be efficient for businesses to find financial success. QuickBooks helps small business owners with a merchant account and credit card processing. Contact Foundant Technologies for Nonprofitcore pricing. Offers and availability may vary by location and are subject to change. Patriot is a great accounting and payroll software choice that offers the most essential payroll and accounting features in an easy to use, affordable package. At a low monthly fee, you get hands on support from dedicated accounting and bookkeeping specialists who handle the task on your behalf and ensure your business remains compliant to avoid frequent IRS audits. Easy to find costing information. No, you can submit all your tax reports directly from Sorted. 7/5, which is the highest research score of any accounting software we’ve tested.

Filter Results 167

Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox. Boost the speed and efficiency of your restaurant operations using our downloadable templates. As an open source software, it can be reprogrammed to have additional capabilities beyond the standard version. Growing hospitality companies like yours have saved hundreds of hours a year with automated consolidations, shortened their monthly close from one month to one week, and in some cases, avoided 2 additional hires after implementation. It not only organizes your payments, expenses, incomes and invoices but also provides a quick overview of where your business stands financially at a click of a button. The FreshBooks dashboard is simple to navigate and includes time and expense tracking, project management features, and tools to create proposals that you can send to prospective clients. The primary purposes of this system are bookkeeping and financial tracking. Here are the plan options. Deskera Books serves a variety of users with its robust features and different plans. As previously covered in our KashFlow review, KashFlow is aimed at small and growing businesses. Server and email outage reports to: irc://irc. Transaction Pro is a software solution that can help you keep QuickBooks up to date by easily importing, exporting, and deleting data. All plans come with award winning support, an intuitive mobile app, over 700 app integrations, and there isn’t a contract in sight. The PocketSmith experience is about you and your money, you will not be sold other products along the way. Suggested Read: Top Advantages of Accounting Software for SMBs and Startups. Xero is a cloud based accounting package that allows small businesses to keep track of their numbers with receivables and payables, along with sales tax and financial reporting. Plus, Zoho’s full fledged accounting software, Zoho Books, has a free plan for businesses that earn less than $50K USD per year.

Post Implementation Success Support

Advanced Reportingis included in all QuickBooks Desktop Enterprise subscriptions. Personal accounting management software helps your business with tax preparation. Personal accounting systems convey any piece of information which is essential or related to your business product. You can use the same system to pay all vendors, even those located outside the U. Freshbooks’ basic plan, Lite, with its unlimited invoices, expense entries, time tracking, and estimates, was one of the most generous we’d come across. Solid reporting capabilities. In addition, many businesses are looking for cloud based software solutions for easy access, whether employees are working in the office or remotely. Plus offers more control over your budget, employee time, stock management, and project productivity, and has a five user limit. If you’re less confident though, it could be worth paying a bit more to ensure there’s always someone to call if/when you run into problems. Here are some of our team’s takeaways and learning from the 2 day Fintech Nexus USA conference. It enables you to manage invoices, track payments, and monitor your cash flow. I wouldn’t recommend it, especially for companies with many years worth of data. Bookkeeping and accounting software both reduce the amount of time spent on data entry. Best for Industry specific features. CIS Domestic Reverse Charge VAT compliant. Of course, you will want basic features such as invoicing, inventory management, credit card charging facility, sales tax incorporation, and essential bookkeeping solutions. Its financial management solution provides the functionalities for finance and accounting, billing, and financial reporting.